We’ve all heard tales of Wall Street traders making it big overnight, as we desperately wished we knew what the secret recipe for success was. In this modern era, the secret isn’t just in intuition or luck; it’s in understanding how AI is being used for stock trading.

With the power of Artificial Intelligence, traders can analyze markets with precision, spot trends before they’re obvious, and make decisions at unparalleled speeds.

AI is not just a buzzword; it’s a game-changer that’s reshaping the finance world. In this article, we’ll dive deep into the transformative role of artificial intelligence stock trading and guide you on harnessing its potential for smarter, more informed decisions.

The Evolution of Stock Trading

In the past, stock traders relied heavily on intuition and personal experience for their trades, as they shouted from the NYSE floor throwing up hand signals to verify trades for their firm. As technology evolved, algorithms came into play, letting us automate certain aspects of trading. This helped increase efficiency but still had limitations due to its rule-based nature.

This all changed with supercomputers and algorithmic trading. By leveraging mathematical models based on pre-set instructions or strategies, it eliminated human error from transactions while also allowing high-frequency trades that were previously impossible by human standards alone.

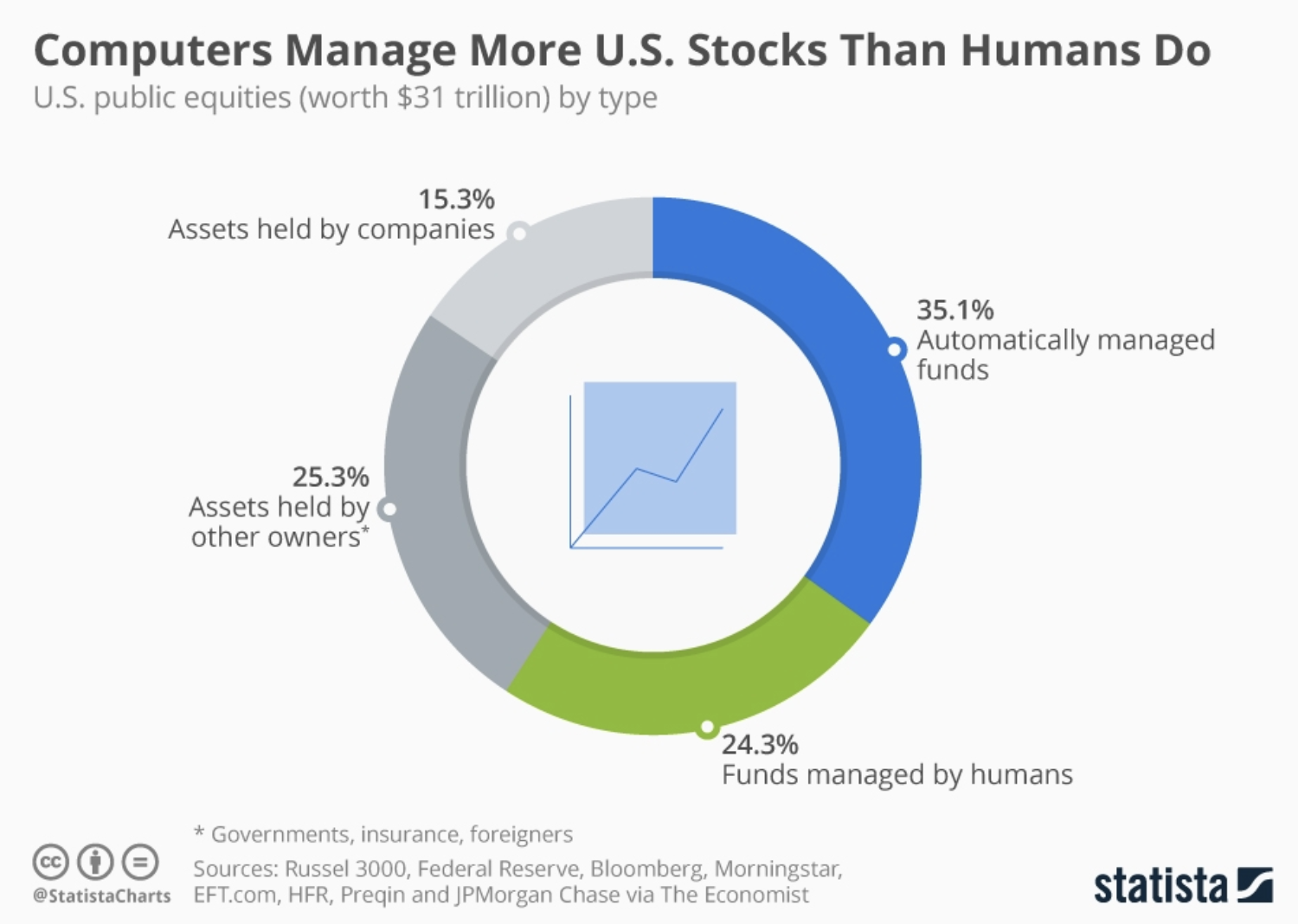

According to Statistica: these days, computers manage more U.S. stocks than humans do!

Understanding AI and Its Components

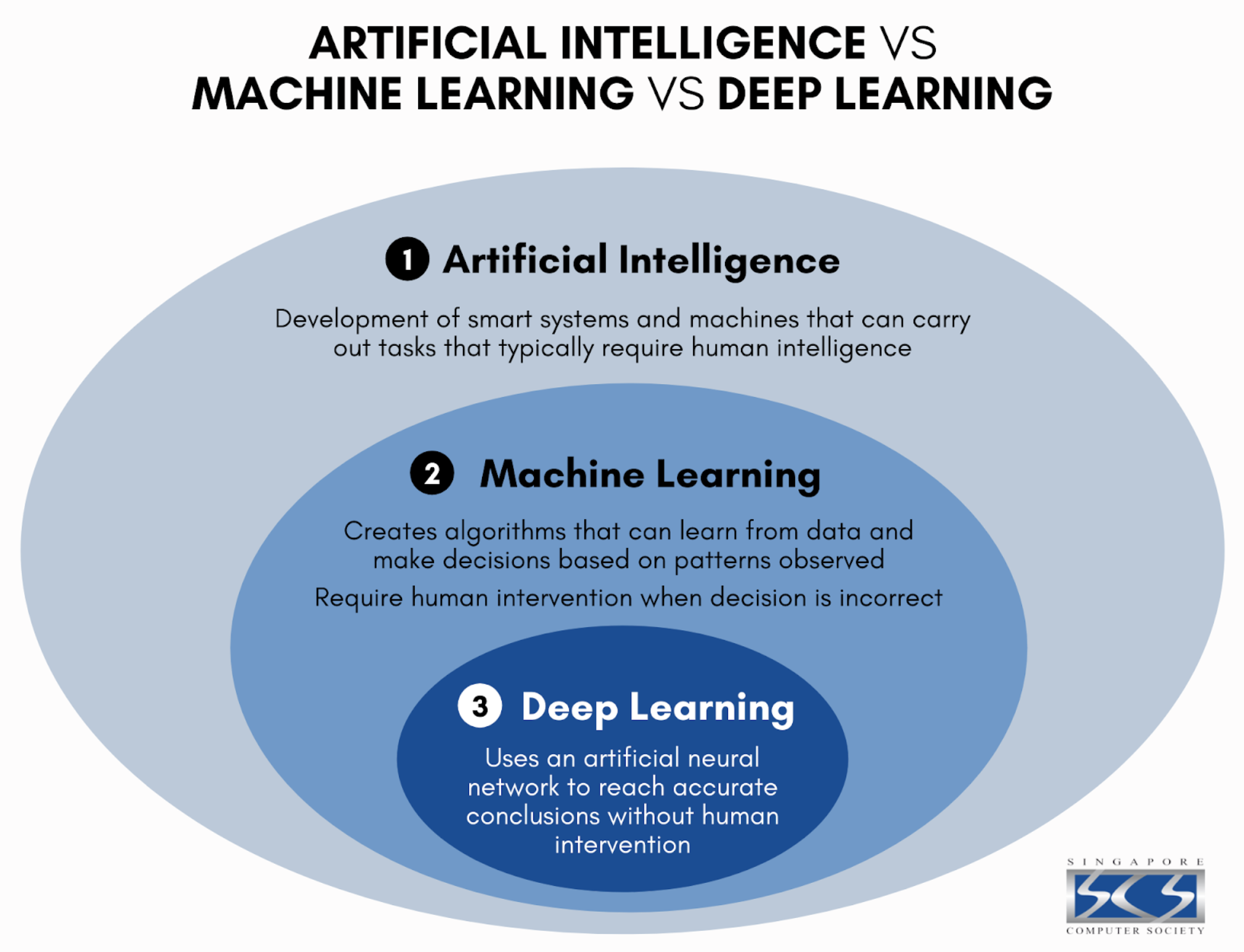

Artificial intelligence (AI) has become a buzzword in the stock trading world. But what is it, really? At its core, AI refers to computer systems capable of performing tasks that typically require human intelligence. This includes activities like speech recognition and decision-making.

As we just mentioned, AI trading (often referred to as algorithmic trading), stands out due to its ability to analyze vast amounts of data at incredible speeds. It leverages machine learning algorithms to discern patterns, trends, and potential market opportunities.

Machine Learning: The Powerhouse of AI

In traditional investing or manual trading, humans are at the helm. We analyze reports, stay updated with news, and make decisions based on experience and intuition. Throw machine learning into the mix and the trading landscape shifts dramatically.

Machine learning equips trading platforms with the capability to not only make decisions based on historical market data but also to continuously learn from new information. The result? These platforms evolve and adapt, refining their market trading strategies with fresh data, ensuring portfolios remain profitable even amidst market upheavals.

Deep Learning: Delving into Complex Data Patterns

Deep learning takes the concept of neural networks a step further. While a basic neural network might have a few layers of nodes to process information, deep learning networks have many layers. These “deep” layers allow the system to process data in increasingly abstract ways.

For instance, in image recognition, initial layers might recognize edges, and the next layers identify shapes, followed by layers that detect more complex structures. By the time data passes through all the layers, the deep learning model has a very nuanced understanding of the input. It’s this depth that allows deep learning to tackle some of the most complex problems in AI, from understanding human speech to generating realistic images.

Now that we have a basic grasp of AI’s intricate layers, from machine learning to deep learning, we can now delve into the practical applications and tools that harness this technology.

These AI-driven tools, such as robo-advisors and trading bots, are revolutionizing the trading landscape. Let’s explore how these components come together to create a new era of artificially intelligent stock trading.

Types of AI Trading Tools

Artificial Intelligence has stormed into the trading arena, and it’s here to stay. But let’s be real; understanding these advanced technologies can sometimes feel like you’re trying to decode alien language. Fear not, because we’ve got your back. Let’s dig into some different types of AI trading tools.

Robo-Advisors: The Personal Assistants of Investing

No more sleepless nights studying stock trends. Robo advisors are automated solutions that manage your portfolio based on pre-set criteria.

The best part? They’re powered by complex AI algorithms capable of learning technologies and analyzing market conditions faster than even multiple brokers could. It’s like getting investment advice from a supercomputer rather than Uncle Bob at Thanksgiving dinner. More about robo advisors.

AI Trading Bots: The Future of Stock Trading

Imagine having an assistant who never sleeps or takes breaks but is constantly analyzing market trends and making calculated decisions via real-time data points for your portfolio. That’s what AI stock trading bots do! They use complex algorithms to analyze vast amounts of data from multiple sources in real time, identify patterns, predict future price movements, and execute trades accordingly.

Their decision-making process isn’t influenced by emotions like fear or greed that often lead human traders astray. Instead, these investment algorithms base their actions purely on logic and statistical analysis – leading to potentially more profitable trading opportunities!

Difference Between AI Trading Bots And Robo Advisors

You might be thinking now: “Aren’t these just like robo advisors?” Not quite! While both employ automation and algorithmic strategies, there are key differences between them.

- Data Analysis: Robo advisors generally use historical data for long-term investment planning while AI bots utilize real-time data for immediate action – perfect for day traders!

- Risk Management: Unlike robo-advisors which typically follow a passive AI investing strategy with lower risk levels over longer periods, AI-powered stock trading bots can take in higher-risk short-term trades if their algorithms detect potential gains.

- Fees: Often times robo advisors charge a percentage of the assets managed, while AI trading bots usually have a one-time purchase cost or subscription fee.

In essence, if you’re looking for more active involvement in stock markets with potentially higher returns (and risks), then AI trading bots might be your new best friend. They offer an exciting opportunity to leverage technology and big data analytics for smarter investment decisions – something that every trader should consider!

AI Trading Software:

Research Automation: Your Private Detective in Market Research

If Sherlock Holmes was reborn as software, he’d probably look something like research automation tools. These help us gather vital data related to markets and stocks, analyze them thoroughly, and present valuable insights that otherwise might take ages to compile manually. Learn more about research automation tools here.

Alert Assistance: Because Timely Alerts Matter

In the dynamic world of stock trading where time literally translates into money, alert assistance comes as our knight in shining armor. This AI software provides timely alerts based on specific market conditions, so you never miss an opportunity. It’s like having a vigilant watchman who alerts you about potential dangers and opportunities. Check out some top alert assistance tools here.

Alert Execution: Making the Moves for You

These alerts are no ordinary occurrence – they’re the key to transforming your trading experience from a loss to a gain. Trade execution tools spring into action automatically based on these alerts.

Key Thought:

AI trading tools make stock market investment more accessible and less stressful. Robo advisors act as your personal investing assistant, while research automation is like having Sherlock Holmes on speed dial for market insights. Alert assistance keeps you informed about crucial changes in the market conditions promptly and trade execution tools let trades happen automatically based on these alerts.

Benefits of Using AI in Stock Trading

As stock market trading continues to evolve, the use of AI technologies is becoming more prevalent. The benefits are undeniable and come with a range of advantages that have reshaped the industry.

Precision and Accuracy: Making Data-Driven Decisions

The precision and accuracy AI offers can’t be matched by human technical analysis alone. AI systems can utilize large quantities of data to make decisions based on facts. This leads to more precise investment choices based on a wide range of real-time information.

In contrast, humans might miss important signals or misinterpret them due to cognitive biases, i.e.: it just didn’t feel right. But thanks to machine learning algorithms used in AI, these errors are greatly reduced if not eliminated entirely.

Speed: Real-Time Analysis and Instant Decision-Making

A key advantage of using AI in stock trading is speed. Market conditions change rapidly – often within fractions of a second. Traditional methods simply cannot keep up with this pace.

Forbes notes, “AI can analyze large volumes of data at incredible speeds”, enabling instant decision-making with imperative execution, which gives traders an edge over their competitors who rely solely on human analysis. In short, AI helps SAVE TIME.

Predictive Analysis: Forecasting Market Trends

Beyond just analyzing current market trends, one major benefit of utilizing AI is its predictive capabilities for forecasting future trends as well.

“With enough data, machine learning algorithms can predict future trends with a high degree of accuracy,” says Entrepreneur magazine. Traders can take advantage of AI’s forecasting abilities to gain an edge and maximize their gains.

Risk Management: AI’s Role in Minimizing Losses

The use of AI stock trading also plays a significant role in risk management. By recognizing patterns and predicting possible downturns, AI can help minimize losses by signaling when it might be best to sell or avoid certain stocks.

A study from the IEEE found that AI-based trading systems can effectively reduce risk and improve overall portfolio performance.

Key Thought:

Power Up Your Trades with AI: Artificial Intelligence reshapes stock trading, offering precision, speed, and predictive abilities that outshine human analysis. By harnessing real-time data for more accurate decisions, analyzing market conditions at lightning speeds, forecasting trends, and minimizing risks – it’s clear: using AI in your trades gives you a competitive edge.

How To Use AI for Stock Trading

Now that we have talked about the WHAT and the WHY, let’s talk about the HOW.

Navigating the world of AI stock trading might seem daunting, but it’s all about using the right tools to make smarter decisions. AI offers practical solutions, from automated systems that handle trades to algorithms that can read market vibes. In this section, we’ll break down the key ways AI is changing the game in stock trading, making things more efficient and insightful.

Automated Trading Systems

The employment of Automated Trading Systems (ATS) driven by AI has transformed the way stock trading is conducted. These systems let traders establish specific rules for both trade entries and exits that once programmed, can be automatically executed via computer.

This means you don’t have to glue your eyes to financial news or charts all day long. The ATS does the heavy lifting for you – making data-driven decisions based on predefined parameters. But remember, while this system offers convenience and efficiency, human oversight remains crucial to avoid costly mistakes.

Sentiment Analysis

Sentiment analysis, another application of AI in stock trading helps gauge market sentiment by analyzing vast amounts of data from social media platforms, blogs, and news articles.

In other words, if there’s chatter about certain stocks performing well on Twitter or Reddit threads – an effective sentiment analysis algorithm will pick up these cues helping investors predict potential market movements before they happen.

Fraud Detection & Prevention

A sad truth about finance: where there’s money involved; fraudulent activities follow suit. But AI is helping to fix this. By analyzing patterns and anomalies in trading data, AI can detect fraudulent activities faster than traditional methods.

This early detection not only helps save millions of dollars but also maintains the integrity of the market – making it a safer place for investors like you and me.

Portfolio Management

The final application we’ll discuss today is portfolio management. In the world of stock trading, managing a portfolio is akin to orchestrating a symphony. Every investment decision, and every asset allocation, plays a crucial role in the overall performance.

With its complex algorithms, AI takes the guesswork out of the equation. It can sift through vast amounts of data, perform market analysis, understand historical performances, and trigger economic indicators. By doing so, AI optimizes investment strategies and portfolios, ensuring a harmonious balance between risk and reward.

AI tailors strategies based on an investor’s specific goals and risk tolerance, making portfolio management more efficient and personalized than ever before.

The true test of any technology is its application, and AI is no exception. In the next section, we’ll delve into a few case studies that showcase the transformative impact of AI in the stock trading arena. Join us as we explore how theory meets practicality.

Case Studies: Success Stories and Lessons Learned

In the world of stock trading, AI has become a pivotal player. Let’s look at the evidence for ourselves. Examine some instances of how AI has had an effect on stock trading.

JPMorgan Chase & Co.: The Advent of LOXM

JPMorgan, one of the leading financial institutions globally, implemented an advanced machine learning algorithm called LOXM to help with its trading operations. This tool can make split-second decisions on buying or selling trades based on current market conditions – faster than any human could ever hope to achieve.

The results? A significant increase in trade execution efficiency and profitability. While the project proved to be a significant success, there were also lessons learned about managing expectations and effectively blending new technology into existing systems.

Fidelity Investments: Harnessing Sentiment Analysis

Fidelity Investments, another major player in finance, leveraged AI’s sentiment analysis capabilities to gauge public opinion towards different stocks from social media data. Using natural language processing (NLP), their system interprets nuances like sarcasm or emotion that traditional algorithms might miss.

This approach gave Fidelity unique insights into market trends before they became apparent through other means—proving that being creative with your use of AI can lead to surprising benefits. However, this method also highlighted challenges such as interpreting ambiguous language and maintaining privacy regulations while scraping online data.

Renaissance Technologies: A Pioneer in AI Trading

Perhaps one of the most famous examples is Renaissance Technologies, a hedge fund that has been using machine learning algorithms for trading since as early as 1988. Their flagship Medallion Fund has achieved average annual returns of over 39% after fees, an unheard-of success rate.

But, this stellar show of skill isn’t just a spectacle of proprietary algorithms. It’s proof of the potential that cutting-edge AI techniques hold for trade ideas.

Tools and Platforms: Getting Started with AI in Stock Trading

If you’re looking to dip your toes into the world of AI-assisted stock trading, selecting the right tools is essential. These platforms can make or break your success by offering various features that cater to different needs.

Picking a Suitable Platform

Firstly, consider what you need from an AI trading tool. If speed is paramount for day traders, they may prioritize real-time data analysis and fast execution speeds over other features. Hedge funds or long-term investors might prioritize predictive analytics, as it offers insight into potential long-term future movements in the market.

A suitable platform should also have robust security measures in place to protect user data and funds against cyber threats. And let’s not forget about user-friendliness – if navigating through complex menus feels like solving a Rubik’s cube blindfolded, then perhaps that platform isn’t quite cut out for beginners.

Exploring Popular Tools

The market has several leading contenders when it comes to top-notch AI trading platforms.

Trade Ideas, for instance, is a financial technology platform tailored for active traders, aiming to provide them with a competitive edge in the market. This AI-driven analysis software offers real-time market scanning, AI-driven trade signals, customizable alerts, and advanced charting capabilities.

Tickeron, on the other hand, is an AI-powered trading platform designed to elevate your trading experience. This interactive marketplace harnesses the power of sophisticated artificial intelligence to transform raw stock market data into actionable market intelligence. Unlike basic stock screeners, Tickeron’s tools are advanced, offering a comprehensive suite of research and analysis capabilities.

Note: Check out our complete list of Top AI Tools for Trading in our article Top AI Trading Software: Mastering Stock Markets in 2024.

Navigating Free vs. Paid Features

Budget considerations will undoubtedly play a part in choosing your AI trading platform. Some platforms offer free services but often come with limitations, such as only access to basic features or a cap on the number of monthly trades.

Paid plans usually unlock more advanced tools and allow for unlimited transactions, so weigh up these pros and cons before making a decision. And remember – just because it’s expensive doesn’t necessarily mean it’s better.

Ethical Considerations and Challenges

The rise of AI in stock trading has not been without its fair share of ethical considerations. The question that begs to be asked is: How far can we let algorithms make decisions on our behalf? ResearchGate discusses this concern.

Market Manipulation Risk

A major issue is the risk of market manipulation. Given the vast amount of data AI systems analyze, they could theoretically manipulate markets if programmed with such intent. This may lead to unfair advantages for those who have access to these advanced tools while others get left behind.

We’ve seen it happen before; flash crashes caused by high-frequency trading algorithms are a stark reminder of what happens when things go wrong – as outlined in this article from Financial Times.

Over-reliance on Technology

A potential hazard to be aware of is leaning too heavily on tech. We must remember that AI models are built by humans, which means they’re susceptible to computational human error and bias. Plus, no matter how sophisticated an algorithm might be, it cannot fully understand or predict all aspects and nuances within global financial markets.

This lack of comprehensive understanding was evident during Black Monday in 1987 when computerized sell-offs contributed heavily towards one fateful day’s catastrophic losses – more details can be found in this Investopedia article.

Importance of Human Oversight

But, amidst these challenges lies the importance of human oversight. The need for humans in the loop isn’t just to monitor AI performance or intervene when things go wrong – it’s about ethics too.

We’re still responsible for ensuring fair play and making sure that our technologies don’t exacerbate social inequalities. We need a system where everyone has an equal opportunity to thrive, even as we move towards more sophisticated trading tools like AI.

This concept is explored further in JSTOR’s study on Technological Advancements and IT’s Market Impact.

Key Thought:

AI’s rise in stock trading sparks key ethical questions, like the extent of decision-making we hand over to algorithms. We must consider risks like market manipulation and unfair advantages for some traders. However, despite technology’s allure, we can’t forget its human-made flaws or underestimate our responsibility for fair play. Ensuring equal opportunities as AI tools advance is crucial.

The Future of AI in Stock Trading

Envision yourself a soothsayer, with the capacity to foresee the stock market’s changes. You’d be unstoppable, right? Well, that’s exactly what artificial intelligence (AI) aims to do for stock trading strategies.

Predictions and Trends for the Next Decade

With advancements in technology like Quantum computing, we can expect more accurate forecasting models from AI. It will not only analyze historical data but also consider social trends and geopolitical factors influencing market dynamics.

A report by Grand View Research predicts that by 2025, the global AI in finance market size is expected to reach $9.1 billion. That’s like every person on earth giving a dollar… nine times over.

Role of Emerging Technologies: Quantum Computing & Augmented Reality

- Quantum Computing: powerhouse has potential far beyond our current computational capabilities. Think about this; if regular computers are your reliable city bus service, then quantum computers are teleportation devices. With its power harnessed properly within trading algorithms – quantum computing will change everything.

- Augmented Reality: AR in financial services might sound straight out of a sci-fi movie – imagine holographic charts popping up at your desk. But it’s not as wild as you think. This could provide traders with an immersive experience to view complex data sets intuitively and make quick decisions.

Riding The Wave Of Change In Stock Trading

No doubt these developments present both exciting opportunities and unique challenges alike.

AI won’t replace experienced traders overnight, but the landscape will definitely shift. We’re heading towards a future where AI is our co-pilot in navigating market volatility.

Exciting times are ahead for the financial exchanges.

Additional Resources

To help you get a better understanding of AI in stock trading, we’ve compiled a list of resources filled with expert insights. These materials are filled with practical knowledge from experts who have been there and done that.

This whitepaper on the use of deep learning for stock market prediction gives an eye-opening perspective on how AI can analyze complex patterns to predict future trends. It’s a bit technical but well worth your time if you’re serious about using AI in stock trading.

If books are more your style, “Predictive Analytics: The Power to Predict Who Will Click, Buy, Lie or Die”, by Eric Siegel is a must-read. It explores predictive analytics across various industries including finance – making it perfect for anyone interested in AI-driven forecasting.

- Courses:

- The online course “Machine Learning“, offered by Stanford University on Coursera will give you the fundamentals needed to understand and implement machine learning algorithms.

- If Neural Networks fascinate you as much as they do us at PivotPoint LLC, then Andrew Ng’s Deep Learning Specialization is what you need. Check out this excellent series over at Coursera.

- Seminars:

- We recommend attending the annual ‘AI World Forum‘, a global event that brings together AI leaders to discuss the latest advancements in artificial intelligence and their applications, including finance.

Remember, it’s not just about having the facts; you need actionable insight into how to use AI for stock trading. This Investopedia article outlines how algorithmic trading functions, providing actionable insight and real-world illustrations to help you use AI for successful strategies.

Conclusion

AI has changed the game in stock trading. It’s not just about making fast decisions anymore, but smart ones too.

Remember how we explored AI’s components like Machine Learning and Neural Networks? These are your tools for precision and accuracy.

We also saw how AI could predict market trends or detect fraud, remember?

You’ve learned practical applications of these technologies – automated processes, sentiment analysis, portfolio management… all aimed at giving you an edge.

We shared success stories to inspire you, and challenges faced to prepare you. And even gave tips on picking out the best AI trading platforms.

In a nutshell: You now know how AI is being used in Stock Trading.

FAQs

Does AI work for stock trading?

Yes, AI can be a potent tool in stock trading. It helps predict market trends, makes data-driven decisions instantly, and manages risk effectively.

Are AI trading bots profitable?

Absolutely. With their ability to analyze massive amounts of market data swiftly, AI trading bots can identify profitable opportunities that humans might miss.

How do you train AI to trade in stocks?

To train an AI for stock trading, you feed it historical price data along with relevant financial information, so it learns patterns and applies them to future trades.

What are the techniques used by artificial intelligence for trading?

The primary techniques include machine learning algorithms for predictive analysis, neural networks for pattern recognition, and deep learning models to understand complex market dynamics.