The world of finance is no stranger to innovation, and the rise of Artificial Intelligence (AI) presents an exciting leap forward.

A significant aspect of finance where AI has started leaving its mark is accounting – a domain traditionally laden with manual processes and vast amounts of data. The dawn of AI Accounting Software signals a huge shift that’s transforming how businesses are handling their finances.

It’s not about replacing accountants with robots; instead, it’s about empowering them. With mundane tasks automated by intelligent systems, professionals can focus more on strategic financial planning – turning numbers into narratives and providing insightful business advice.

In fact, according to research from Accenture, AI could automate up to 80% of accounting tasks by 2024. This could be as revolutionary for accountants as the first digital calculators were back when they first hit office desks.

So, are you ready for the age of AI in finance? Buckle up as we explore some of the best financial management tools available, and uncover the pros and cons of this transformational software.

Understanding AI in Financial Management

AI has completely changed how we manage our finances, replacing manual calculations and human expertise with automated processes. Once seen as a field dominated by human expertise and manual calculations, modern-day accounting practices have embraced AI to streamline processes, improve accuracy, and generate insights.

According to Forbes, businesses are now using AI-based software not just for mundane tasks like data entry but also complex ones such as tax compliance.

Accounting Redefined: A Paradigm Shift

In today’s rapidly evolving business landscape, accounting software has become more than just a tool for recording financial transactions. With the integration of AI and advanced algorithms, these platforms now offer a wide range of functionalities tailored to specific business needs. To help you navigate this diverse ecosystem, we’ve categorized the leading software into three main types:

1. Comprehensive AI Accounting Software

All-in-one solutions that handle a broad spectrum of accounting tasks, from invoicing to payroll and financial reporting. Ideal for businesses looking for a singular platform to manage all their financial operations.

2. AI-powered add-ons for Enhanced Accounting Automation

These are specialized tools designed to complement and enhance your primary accounting software. They focus on automating specific tasks, offering in-depth financial analysis, or streamlining certain accounting processes.

3. HR, Expense Management, and Payroll Solutions

While not exclusively accounting software, these platforms play a crucial role in financial management. They specialize in human resources, expense tracking, or payroll processing, ensuring that these specific aspects of your business run smoothly and efficiently.

With this categorization in mind, let’s delve deeper into each type, exploring the top players, their features, and how they can benefit your business.

Top Comprehensive AI Accounting Software Tools

Comprehensive AI accounting software revolutionizes financial management by harnessing the power of artificial intelligence. These platforms enhance accuracy, automate data entry, and provide predictive insights that streamline traditional accounting tasks. By adopting one of the solutions listed below, businesses can leverage data-driven insights for growth and ensure efficient financial operations.

1. Zoho Books: Smart Accounting for Growing Businesses

Zoho Books is a comprehensive accounting solution designed for small to medium-sized businesses. It offers a wide range of features, from invoicing to inventory management, all within an intuitive interface. Zoho Books is part of the larger Zoho suite of business applications, allowing for seamless integration with other Zoho products, and enhancing its utility for businesses already invested in the Zoho ecosystem.

Having explored Zoho Books, the standout feature is its user-friendly layout, both on the web and mobile platforms. The mobile app, in particular, is a game-changer for on-the-go professionals, allowing for instant uploads of receipts and invoices. Additionally, the software’s capability to assign expenses to specific employees or even projects provides granular control over financial tracking. This level of detail, combined with real-time reporting, makes it easier to monitor the financial health of projects and teams.

Key Features/Benefits:

- User-friendly Interface: Intuitive design on both desktop and mobile platforms.

- Expense Tracking: Assign expenses to specific employees or projects for detailed financial insights.

- Integration: Seamless connectivity with other Zoho applications and popular banking platforms.

- Real-time Reporting: Generate reports on sales, expenses, and employee performance.

- Collaborative Features: Create topics and comment on invoices and estimates, facilitating discussions with team members.

Cons/Drawbacks:

- Data Import Limitations: Challenges faced when importing invoices from other software, leading to uniform descriptions.

- Email Restrictions: Cannot use the same email address for different “employees” or expense categories, which can be limiting for administrators handling multiple roles.

Pricing:

- Free: $0 / month

- Standard: $15 / month

- Professional: $40 / month

- Premium: $60 / month

- Elite: $120 / month

- Ultimate: $240 / month

2. Xero

Xero is a cloud-based, double-entry accounting software tool designed with small businesses in mind. Catering to over 3.5 million users globally, Xero offers a comprehensive suite of features, from invoicing to financial reporting. As part of its offering, Xero provides transparent pricing plans tailored to different business needs, ensuring that both startups and established businesses can benefit from its features.

Upon evaluating Xero, its integration capabilities and user-friendly setup process are commendable. Xero‘s app store boasts over 1,000 prebuilt connections that integrate seamlessly with third-party apps, outpacing many of its competitors. Additionally, the software provides a highly guided setup process, complete with pop-up windows and tutorials, making it accessible even for those new to accounting software. The inclusion of a demo company account for practicing dummy data further enhances its user experience.

Key Features/Benefits:

- Unlimited Users: Even on the lowest tier plan, Xero offers unlimited user access.

- Integrations: Over 1,000 prebuilt connections with third-party apps.

- Guided Setup: Comprehensive tutorials and a demo company account for hands-on practice.

- Financial Reporting: Comprehensive financial reports, including balance sheets, aged receivables, and inventory reports.

- Documentation Management: Built-in integration with Hubdoc for data extraction and Xero Expenses mobile app for receipt capture.

Cons/Drawbacks:

- Entry-level Plan Limits: The Early plan restricts users to 20 invoices and five bills per month.

- Advanced Features on Premium Plan: Features like multiple currencies and time tracking are exclusive to the most expensive plan.

Pricing:

- Early: $7.50 / month

- Growing: $21 / month

- Established: $39 / month

3. Sage Business Cloud Accounting

Sage Accounting is a prominent AI-driven accounting software tailored for small to medium-sized businesses. It offers a range of plans to cater to different business needs, from basic invoicing to comprehensive financial management. With its competitive pricing and a suite of features, Sage Accounting positions itself as a cost-effective solution for businesses looking to streamline their financial processes.

Having tested Sage Accounting, one feature that truly stands out is its multi-currency support. For businesses that frequently deal with international transactions, Sage’s ability to handle various currencies seamlessly is invaluable. It not only allows for transactions in different currencies but also provides insights into how fluctuating exchange rates can impact cash flow. This feature, combined with its intuitive interface, makes Sage a top choice for businesses with a global clientele.

Key Features/Benefits:

- Invoicing: Create, send, and track unlimited invoices. Automated recurring invoices and customizable templates.

- Integrations: Over 40 software integrations, including payment processors and payroll software. Also integrates with Zapier for additional automation.

- Multi-currency Support: Handle transactions in various currencies and monitor exchange rate impacts.

- Inventory Tracking: Real-time stock level tracking, reorder notifications, and product categorization.

- Business Reporting: Comprehensive financial reports available in real-time, including cash flow statements and profit analysis.

Cons/Drawbacks:

- Payment Limitation: The software is limited to Stripe for online transactions.

- Interface: Some users have mentioned a preference for a more modern interface compared to competitors.

Pricing:

- Pricing varies

Top AI-powered add-ons for Enhanced Accounting Automation

AI-powered add-ons for accounting automation elevate the capabilities of traditional financial management systems. These specialized tools integrate seamlessly with primary accounting platforms, providing advanced functionalities that automate specific tasks and deliver in-depth financial analysis. By integrating these add-ons, businesses can optimize their accounting processes, minimize manual interventions, and harness real-time insights for informed decision-making.

1. Melio

Established in 2018, Melio is a business payment solution headquartered in New York, designed to assist businesses in managing their bills, invoices, and overall cash flow. It caters to a variety of sectors, including logistics, wine and spirits, food and beverage, and retail. While Melio primarily serves US businesses, it facilitates payments to vendors globally. Trusted by renowned institutions like Silicon Valley Bank, J.P. Morgan, and Diners Club International, Melio has earned an A+ rating from the Better Business Bureau (BBB). The platform integrates with popular accounting software, offering a plethora of features to optimize payment processes and maximize working capital.

One of Melio‘s standout features is its “Easy Bill Capture.” This tool allows users to effortlessly import bills, either manually, by uploading a file, or by syncing them automatically via QuickBooks. Melio‘s AI technology autonomously reads the bill, extracts pertinent information, and schedules the payment, simplifying the process.

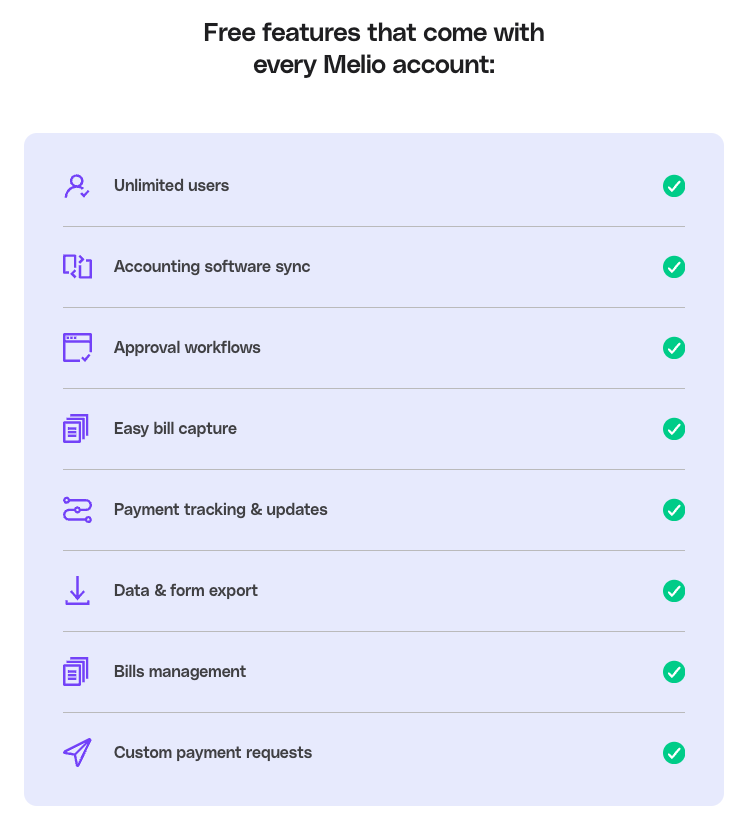

Key Benefits:

- Integration: Seamless integration with accounting software like QuickBooks Online and FreshBooks.

- Dashboard: Centralized dashboard for tracking payments.

- Payment Flexibility: Ability to pay any invoice via various methods, even if the vendor doesn’t have a Melio account.

- User Segmentation: Offers both Business and Accountants sections, catering to diverse needs.

Cons/Drawbacks:

- No Mobile App: The absence of a dedicated mobile app, though the platform is optimized for mobile browsers.

- Delayed Verification: Some users have reported delays in the account verification process and challenges in reaching the compliance team.

Pricing:

- Pricing varies

2. Synder

Synder is an automated online accounting system tailored specifically for e-commerce and SaaS industries. Designed to serve as an ecosystem where business data is stored and analyzed, Synder offers full automation of accounting processes, ensuring cost and time efficiency. By connecting to various payment platforms or sales channels, Synder eliminates the need for manual data entry, providing businesses with accurate and up-to-date financial information.

After diving into Synder, its integration capabilities truly shine. The software seamlessly connects with popular sales channels like Shopify, Amazon, Etsy, and payment providers such as Stripe, Square, and PayPal. This extensive integration ensures that financial data from various sources is consolidated in one place, making it easier to monitor and analyze. Furthermore, its auto-updating Profit & Loss (P&L) feature provides businesses with real-time insights, aiding in data-driven decision-making.

Key Features/Benefits:

- Full Automation: Streamlines accounting processes for efficient back-office organization.

- Real-time Insights: Auto-updating P&L and balance sheet for immediate financial overview.

- Integration Capabilities: Connects with popular sales channels and payment providers.

- Inventory Tracking: Comprehensive tracking across channels, ensuring up-to-date stock levels.

- Invoicing: Generate and send both recurring and one-time invoices, along with smart payment links for faster transactions.

Cons/Drawbacks:

- Setup Complexity: Initial setup might be challenging, especially for non-tech-savvy users.

- Custom Integration Limitations: While Snyder supports many integrations, some niche platforms might not be supported out-of-the-box, requiring feedback and potential wait times for integration.

Pricing:

- Medium: $48 / month

- Scale: $88 / month

- Large: $220 / month

- Enterprise: Call for custom pricing

3. ConnectBooks

ConnectBooks is a comprehensive financial management platform tailored for eCommerce businesses. It integrates data from major eCommerce platforms like Amazon, eBay, Walmart, and Shopify into accounting software such as QuickBooks and Xero. This integration allows businesses to have a consolidated view of their financial data, eliminating the need for manual data entry and ensuring accurate financial reporting.

Having explored ConnectBooks, its standout feature is the seamless integration with major eCommerce platforms. The software provides real-time inventory tracking, ensuring businesses have an accurate view of stock levels across different sales channels. Additionally, ConnectBooks offers real-time profit and sales reports, giving businesses instant clarity on their financial performance. The ability to view and sort data based on various criteria, such as item or seller, makes it a valuable tool for financial analysis.

Key Features/Benefits:

- eCommerce Integration: Syncs data from platforms like Amazon, eBay, Walmart, and Shopify.

- Accounting Software Compatibility: Seamlessly integrates with QuickBooks and Xero.

- Real-time Inventory Tracking: Monitors sales, returns, bundles, and kits.

- Financial Analysis: Provides detailed financial reports for effective business analysis.

- Automated Accounting: Every transaction, fee, sale, return, and expense is synced with 100% accuracy.

Cons/Drawbacks:

- Platform Limitations: While it supports major eCommerce platforms, some niche platforms might not be supported.

- Complex Setup: Some users might find the initial setup and integration process challenging.

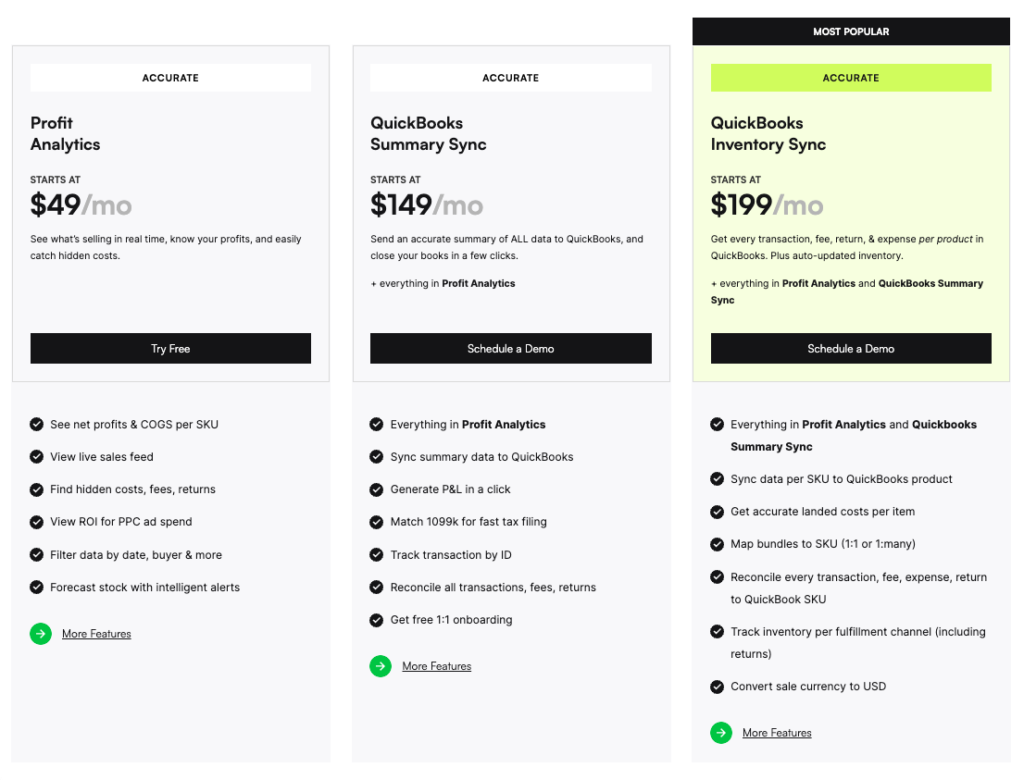

Pricing:

- Pricing varies from:

- $19 / month

- $49 / month

- $149 / month

- $199 / month

HR, Expense Management, and Payroll Solutions

HR, Expense Management, and Payroll Solutions are integral components of a business’s financial ecosystem. These platforms streamline human resources tasks, simplify expense tracking, and ensure accurate and timely payroll processing. By leveraging the advanced capabilities of the solutions listed below, businesses can enhance operational efficiency, ensure compliance, and provide a seamless experience for their employees, all while maintaining a clear view of their financial health.

1. Deel

Deel is a global payroll and compliance platform designed to streamline the process of hiring, managing, and paying international teams. It offers a comprehensive solution for businesses looking to navigate the complexities of international employment, ensuring compliance with local regulations while facilitating seamless payments in multiple currencies.

Deel stands out for its robust global payroll capabilities. It simplifies the intricacies of international payroll regulations, making it effortless to pay employees and contractors regardless of their location. The platform’s integration with popular virtual collaboration tools like Teams, GSuite, and Slack enhances its utility. Additionally, Deel‘s dedicated customer success manager for enterprise clients ensures that businesses receive personalized support tailored to their unique needs.

Key Features/Benefits:

- Global Payroll: Facilitates hassle-free payroll in over 90 countries.

- EOR Services: Provides employer-of-record services to support rapid international scaling.

- Integration: Seamlessly integrates with collaboration tools like Teams, GSuite, and Slack.

- HR Functions: Includes features like PTO management and support for compliance and legal concerns.

- Diverse Payment Methods: Supports multiple payment methods for payroll.

Cons/Drawbacks:

- EOR Pricing: While the EOR services are comprehensive, they can be expensive.

- Scaling Costs: User fees are charged per employee/contractor, so costs increase with workforce size.

- Limited CSM Access: Dedicated customer success managers are only available for enterprise clients.

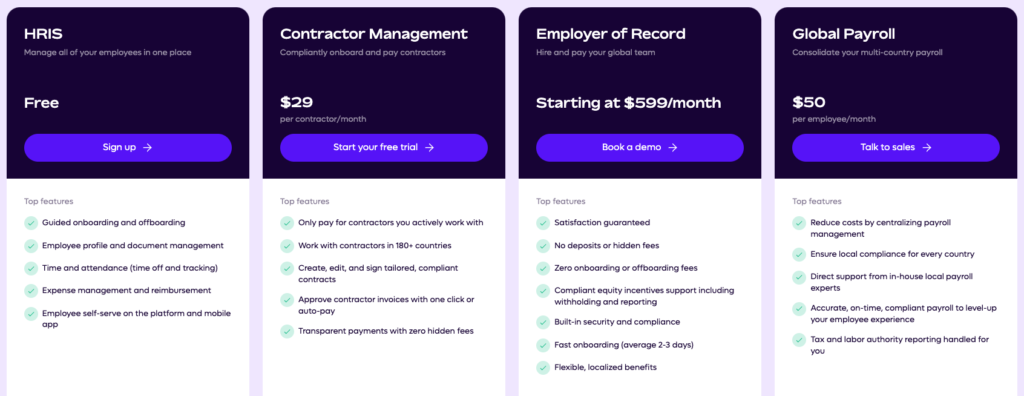

Pricing:

- Deel HR: Free

- Immigration: Contact sales for pricing

- Global Payroll: Contact sales for pricing

- Contractors: $49 / month

- EOR: $599 / month

2. Remote

Remote is a global HR solution designed to facilitate the hiring, management, and payment of international teams. It streamlines the process of international hiring, ensuring compliance with local regulations, and offers tools for payroll, tax, and equity management. Remote is tailored for businesses looking to build a global workforce, providing them with the necessary tools to navigate the complexities of international employment.

Upon evaluating Remote, its standout feature is the comprehensive approach to international payroll management. The platform not only processes payroll but also ensures compliance with ever-changing taxes and regulations in different countries. This is particularly beneficial for businesses that have a diverse workforce spread across multiple countries. Additionally, the platform’s integration capabilities allow businesses to connect with other tools, further enhancing its utility.

Key Features/Benefits:

- Global Hiring: Simplified process to hire international teammates.

- Payroll Management: Streamlined payroll for international employees, ensuring timely payments in local currencies.

- Compliance: Keeps businesses compliant with local tax and employment regulations.

- Integration Capabilities: Connects with other tools to create efficient processes.

- Security & Compliance: Ensures data safety and compliance globally.

Cons/Drawbacks:

- Focused on HR: While it offers payroll and compliance features, it might not replace a full-fledged accounting system.

- Learning Curve: As with any comprehensive platform, there might be an initial learning curve for users unfamiliar with international HR processes.

Pricing:

- HRIS: Free

- Contract Management: $29 / month – per contractor

- Global Payroll: $50 / month – per employee

- Employer of Record: $599 / month

3. Ramp: The Small Business Owner’s Dream Toolset

Ramp is a modern financial management platform designed primarily for businesses seeking streamlined expense management and financial insights. With its user-friendly interface, Ramp offers a suite of tools that simplify expense tracking, approval workflows, and financial reporting. In addition to its core accounting features, Ramp also provides a corporate charge card that offers cashback rewards on every purchase, enhancing its value proposition for businesses.

After testing Ramp, the feature that genuinely distinguishes it is its real-time financial insights combined with its corporate card offering. The card’s 1.5% cashback rewards on every purchase are amazing, but what’s more impressive is the software’s ability to provide real-time alerts, spending controls, and integrations with popular accounting software like QuickBooks and Xero. This integration of financial management tools with a corporate card makes it a unique offering in the market, streamlining expense management while also providing valuable financial insights.

Key Features/Benefits:

- Streamlined Expense Management: Automated expense categorization, receipt capture, and approval workflows.

- Corporate Card: Offers unlimited 1.5% cashback rewards on every purchase.

- Real-time Financial Insights: Provides real-time alerts and spending controls.

- Integrations: Seamless integration with popular accounting software like QuickBooks and Xero.

- User-friendly Dashboard: Intuitive interface for easy navigation and financial overview.

Cons/Drawbacks:

- Balance Limitation: Users cannot carry a balance on the Ramp charge card.

- Not Comprehensive: While robust, Ramp’s primary focus is on expense management, corporate card offerings, and financial insights. While it integrates with other accounting software, on its own, it might not replace a full-fledged accounting system for businesses that require more extensive accounting functionalities.

Pricing:

- Ramp: Free with limited features

- Ramp Plus: $15 / month – per user

- Ramp Enterprise: Contact sales for custom pricing

Key Features of AI Accounting Software

The wave of digitization has made its way into accounting, and it’s transforming the field. The heart of this transformation is AI accounting software. But what makes these advanced tools so special? Let’s dig in.

Automated Calculations and Regulated Processes

In a world where accuracy is paramount, AI comes to our rescue by taking charge of calculations. This not only ensures precision but also saves considerable time for accountants. Additionally, with built-in regulations adherence mechanisms, compliance becomes a cakewalk.

Data Predictions and Faster Analysis

No need to stress over future financial projections anymore. With predictive analytics powered by AI, your accounting software can give you an insightful peek into the future. It doesn’t stop there – rapid data analysis helps firms make timely decisions based on real-time insights.

Better Accuracy in Financial Reporting

A minor error in a financial report can cause a major headache later on. Luckily, improved accuracy is one more perk that we get from using AI-powered accounting solutions.

Real-Time Alerts & Scalability

Rather than waiting until end-of-month reviews to discover errors or anomalies, why not fix them as they occur? That’s exactly what real-time alerts allow us to do when using these cutting-edge platforms. Moreover, unlike traditional systems that require extra work for scalability, artificial intelligence scales with ease, adapting to the growing needs of your business.

The key features we’ve explored show that AI accounting software is more than just a trend – it’s an essential tool for modern financial management. By harnessing its power, firms can increase efficiency and stay ahead in this ever-evolving industry.

Selecting the Right AI Accounting Software for Your Business

When it comes to selecting an AI accounting software, think of your business as a unique entity with specific needs. Rather than focusing on the most advanced system available, it’s important to find one that suits your business perfectly.

Firstly, consider what your needs are – Is it expense reports, bookkeeping services, accounting services, bank reconciliation, income statements, and the list goes on. But whatever the task is, by leveraging AI to assist your financial services you will undoubtedly reduce costs, increase decision-making capabilities, and complete tasks much more efficiently.

But do remember: just because these AI tools have a specific function doesn’t mean they’re automatically right for your company.

Automated Invoice Processing

AI tools that provide automated invoice processing are another game changer. This aspect of accounting can be tedious and prone to mistakes when done manually. An effective solution will take care of invoices swiftly and accurately so you don’t have to worry about late payments or inaccuracies creeping into your financial reports.

AI automation is the name of the game when it comes to bookkeeping tasks as it eliminates human error in accounting work.

Integration Capabilities

You’ll also want something that integrates seamlessly with other systems in use at your organization – whether it’s payroll services or CRM platforms – essentially becoming part of the larger whole rather than sticking out like a sore thumb.

The Power Of Machine Learning Features And Templates

Last but not least, look for machine learning features in your prospective software; these can give predictive insights based on historical data patterns which helps steer decision-making processes towards more profitable outcomes. Using AI technology helps standardize processes and ensure consistency, particularly important if you have multiple people handling your accounts.

Selecting the proper AI accounting program is not a universal solution. Figuring out what you require most from this tech and selecting an answer that meets those needs directly is the secret. The key lies in being discerning, and patient, and keeping an open mind to what these tools provide as they are becoming increasingly popular for accounting workflows.

Key Thought:

Choosing the right AI accounting software is about finding a tailored fit for your business. Consider automated bookkeeping and invoice processing to save time and reduce errors. Seek seamless integration with existing systems, machine learning features for predictive insights, and templates for consistency in tasks.

The Impact of AI on Workflow in Accounting Firms

AI has shaken up the accounting industry. But it’s not about robots taking over – far from it. Instead, we’re seeing a shift from traditional data processors to bookkeeping automation.

This AI software automation has eliminated repetitive tasks like manual entries, increased accuracy in accounting systems, created real-time visibility of future trends, helped with cost savings, and assisted in making better business decisions.

Time Savings and Improved Client Service

No one gets into business accounting because they love data entry. With AI automating tedious tasks, accountants can focus on providing better service to their clients.

Imagine having instant access to accurate financial information at any moment – that’s what AI data brings to the table. By reducing manual errors and delivering real-time insights, firms can make informed decisions and serve their clients faster and more precisely.

Scalability Benefits

Firm growth often means hiring more staff or putting in longer hours—until now. The scalability benefits of using AI are remarkable. Need proof? Just look at how Deloitte uses an ‘audit bot’ army to handle tasks that would otherwise need hundreds of human hours.

Their AI can scale up or down based on the task at hand, which lets firms manage their workload more effectively. It’s like having a team that never sleeps and is always ready for more work.

Challenges and Concerns

Adopting AI in accounting is not without its hurdles. Anxieties about data security and privacy are a primary issue when embracing accounting AI tools. With a surge in cyber-attacks, businesses are understandably wary about how safe their sensitive financial information will be within an AI-based system.

This concern isn’t unfounded. As per an IBM report, the global average cost of a data breach has risen to $4.45 million in 2023, a 15% increase over the last 3 years. But remember, this risk doesn’t just apply to AI systems; any digital platform handling sensitive data needs robust security measures.

The Debate on True Intelligence vs Textual Crowd-Sourcing

A hotly debated topic when it comes to artificial intelligence revolves around its actual ‘intelligence’. Some argue that many so-called ‘AI’ systems are merely good at processing large amounts of text rather than demonstrating real understanding or learning ability.

An example can be seen with OpenAI’s GPT-4 language model which despite impressive feats like translating languages and answering trivia questions, still falls short when asked for more abstract thought processes such as reasoning or creative thinking – something we humans excel at.

Adoption Rates and Future Predictions

Beyond these issues lies another challenge: adoption rates. Many companies may resist change due to fear of disruption or lack of understanding about what AI can truly offer them.

To combat this resistance, education plays a key role – making sure everyone from CEOs down understand not only what AI is but also how it could help streamline their work process. VentureBeat has a great article on overcoming digital adoption challenges that’s worth a read.

Looking forward, AI in accounting is expected to grow significantly. According to Grand View Research, the global AI in accounting market size is predicted to reach $11.8 billion by 2025 – demonstrating just how vital it will become for firms big and small.

Key Thought:

Adopting AI in accounting presents challenges like data security concerns and debates on its actual ‘intelligence’. However, these hurdles shouldn’t overshadow the benefits. By ensuring robust security measures and fostering an understanding of AI’s capabilities, we can overcome resistance to adoption. As predicted, by 2025, the global AI in the accounting market could hit $11.8 billion.

Conclusion

Handling money can be challenging. But with AI accounting software, the game has changed.

These AI tools are increasing accuracy, and bringing precision and speed to your financial management tasks. From calculations to compliance – it covers all!

Big or small, firms are adopting this technology for smoother operations.

However, choosing one isn’t a cakewalk. Look out for key features like automated bookkeeping, transaction categorization, automated bank reconciliation of bank statements, and invoice processing from a general ledger.

We’ve come a long way from traditional data entry processes to now trusting AI as our finance advisor. It’s high time we embrace these changes…

If you’re ready for faster analyses of financial statements, improved accuracy in management expense reports, and real-time insights… If you’re ready to scale without increasing manual work…

Dive into the world of AI accounting software today!

FAQs

Is there an AI accounting software?

Yes, several AI-driven accounting tools exist like QuickBooks, Xero, and Sage that provide automation and data analysis capabilities.

How can I use AI in bookkeeping?

You can leverage AI for tasks such as invoice processing, expense categorization, forecasting revenues or expenses, and detecting fraudulent transactions.

Can AI take over CPA?

No. While it automates routine tasks, the strategic thinking and advisory role of CPAs remain vital. However, they will need to adapt to work with these new technologies effectively.

Does Quickbooks use AI?

Absolutely. QuickBooks uses machine learning algorithms to automate processes like categorizing transactions or suggesting categories based on past inputs.